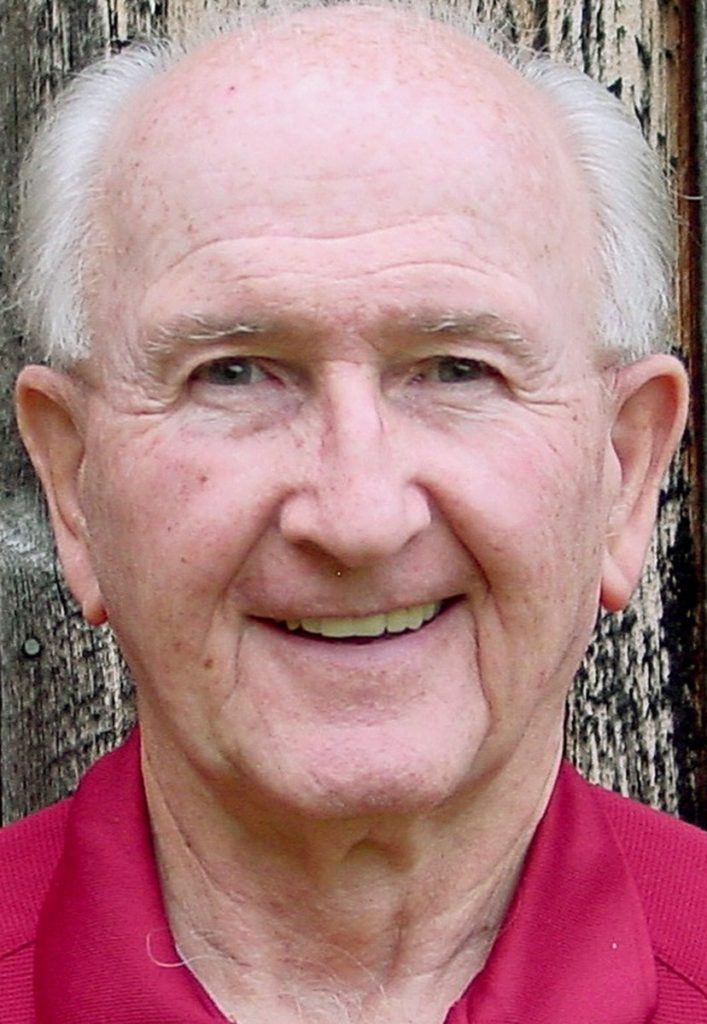

Column by Mike Zagata, September 28, 2018

New York Not So

Great Lately, Either

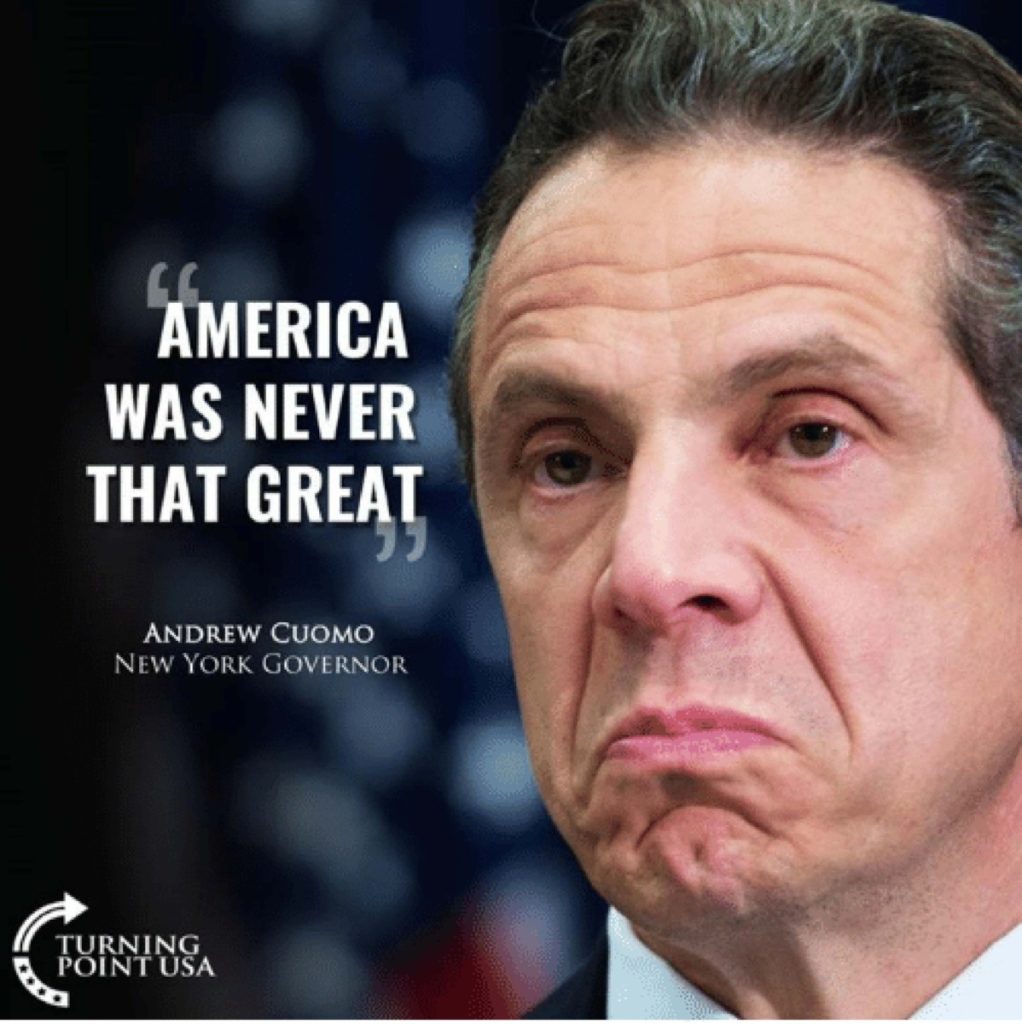

‘America was never that great.”

That’s an amazing quote from a man who’s had nothing but opportunity his entire life. Yes, he’s made the most of it, but that’s not the point. The point is that, because America was great, he had the opportunity to succeed.

Before moving to the point of this article, I thought it might be useful to look at the media via a historical perspective. Thus, I offer the following quote:

“Do not fear the enemy, for your enemy can only take your life. It is far better that you fear the media, for they will steal your HONOR. That awful power, the public opinion of a nation, is created in America by a horde of ignorant, self-complacent simpletons who failed at ditching and shoemaking and fetched up in journalism on their way to the poorhouse.”

Any idea who wrote it? No, not President Donald Trump. It was one of the most revered of our early writers – Mark Twain. If you’re following the path of the current nominee to the Supreme Court, it should ring true.

•

According to that same media, Governor Cuomo is concerned that the recent revisions to the federal tax code will unfairly cost New Yorkers $16 billion in lost deductions. Another way to interpret that concern is that the federal tax code revisions put the spotlight on the “Blue” states – states governed by Democrats – by pointing out that that we are paying too much in taxes. In our case too much is about $16 billion.

According to the governor: “We have high local property taxes and a relatively high income tax.” Is that news to any of us reading this article? About a million folks have figured this out since he became governor and left.

Each time someone leaves New York due to its high taxes, what impact does that have on those of us who remain? By definition, if we expect the same level of government “services,” our taxes must go up.

It’s interesting, the governor chose to lay part of the burden for high taxes off on the local governments by mentioning high property taxes. However, what he neglected to mention is that the county’s obligation for half of the state’s portion of Medicaid drives up local taxes.

•

If I remember correctly the county’s bill for Medicaid was about $11 million. That amount is roughly equal to the money collected from county tax payers. We are being forced to run county government on sales tax revenue and state aid. Our local property taxes go to pay for Medicaid. New York is the only one of the 50 states that does this.

If the government continues to give out money as “candy,” our taxes must go up even more. Some would argue that money leads to local economic growth – I would argue that we need to be certain that it does. Getting a $10 million grant and then using much of it to pay the consultants who oversee it is not a suitable return on investment.

When we read, “Oneonta just received a $250,000 grant and it didn’t cost us anything”, do we take a moment to stop and think about that?

Where does government get its money – from us in the form of taxes, fees and licenses.

This particular project may not have been funded with money from taxes collected from Oneonta residents, but a grant to some other New York community very likely was funded by tax dollars from Oneonta residents – the money all goes into the same “pool.”

•

However, what’s even more troubling is that a governor, who took an oath to uphold the law, has come up with a scheme to circumvent the law (an attempt to get out of that spotlight). His scheme would have enabled taxpayers to contribute to tax-deductible charitable funds set up by the various local governments which would then provide tax credits to the donors equal to 95 percent of the donations value.

As one might expect, the IRS said “no”. Beyond the scam aspect, think about the impact this could have had on the state’s charitable organizations by diverting funds that might have gone to them to local government as disguised taxes instead.

Even more troubling is the mindset that says, “If I don’t like it, I’m not going to abide by it.” Today, it’s all about “me” and how I can scam the system to improve my lot at the expense of others.

•

That has to change if we’re going to make America “GREAT” again. To me, what made America great was having pride in our country and being willing to work hard to make it, and thus our lives and the lives of others, better.

Mike Zagata, a former DEC commissioner in the Pataki Administration and an environmental executive for Fortune 500 companies, lives in West Davenport.